List of Retail Clinics in the USA: Guide for Healthcare Marketers

List of Retail Clinics in the USA: Guide for Healthcare Marketers

In today’s fast-paced healthcare landscape, retail clinics have emerged as a vital player in delivering accessible, affordable, and convenient care to millions of Americans. These walk-in clinics—commonly located inside pharmacies, supermarkets, and big-box retailers—are transforming primary care delivery, especially for non-emergency health needs.

In this comprehensive blog, we will walk you through what retail clinics are, the services they provide, the top chains operating in the United States, and how marketers can reach key decision-makers in this segment using Ampliz Healthcare Data Intelligence.

What Are Retail Clinics?

Retail clinics, also known as walk-in clinics, are healthcare facilities located inside retail stores such as CVS, Walgreens, Kroger, and Walmart. They are staffed by nurse practitioners (NPs) and physician assistants (PAs) and provide basic healthcare services to patients without the need for appointments.

These clinics are a convenient option for patients seeking quick treatment for minor illnesses and injuries, vaccinations, and health screenings.

Key Features of Retail Clinics:

- Walk-in availability

- Located inside retail stores

- Short wait times

- Transparent pricing

- Extended hours, including weekends

- Accept most insurance plans

What Services Do Retail Clinics Offer?

Retail clinics focus on treating low-acuity conditions and providing preventative healthcare. Here’s a breakdown of common services:

- Common Illnesses: Colds, flu, sore throats, allergies, ear infections

- Preventive Care: Vaccinations, flu shots, COVID-19 testing

- Health Screenings: Blood pressure, cholesterol, diabetes screenings

- Women’s Health: Birth control consultations, pregnancy tests

- Physical Exams: Sports, school, and camp physicals

- Chronic Condition Monitoring: Diabetes, hypertension

Top Retail Clinic Chains in the USA 2026

The retail clinic market has grown significantly over the last decade, with several national brands operating hundreds of clinics across the country.

Below are the most recognized retail clinic chains:

1. MinuteClinic (CVS Health)

- Over 1,100 locations nationwide

- Services: Primary care, wellness, minor injuries

- Telehealth integration: Yes

- Accepted insurances: Most major plans

2. The Little Clinic (Kroger)

- ~225 locations inside Kroger stores

- Services: Immunizations, diagnostics, routine care

- Accepted insurances: Broad coverage

3. RediClinic (Rite Aid)

- ~35 locations (some closures due to restructuring)

- Services: Preventive and routine care

- Focus: High-quality affordable care

4. Walgreens Healthcare Clinic

- Transitioning many clinics to partner providers

- Still offers basic care in select markets

- Integration with VillageMD expanding full-service care

5. Walmart Health

- Offers broader services including dental, mental health, vision, and labs

- ~50 locations in select states

- Focus: Affordable pricing, uninsured populations

List of Top 20 Retail Clinics in the USA by Size 2026

| Rank | Clinic Name | Parent Company | No. of Locations | States Covered | Key Services |

|---|---|---|---|---|---|

| 1 | MinuteClinic | CVS Health | 1,100+ | All 50 states | General primary care, immunizations |

| 2 | The Little Clinic | Kroger | 225+ | Midwest, South, Southwest | Wellness, exams, minor illness care |

| 3 | Walmart Health | Walmart | 50+ | GA, AR, FL, IL | Full-service (medical, dental, vision) |

| 4 | Walgreens Clinics | Walgreens | 25+ (active) | IL, TX, AZ | Walk-in care, testing |

| 5 | RediClinic | Rite Aid | 30–40 | PA, NJ, TX | Preventive care, screenings |

| 6 | CareNow Clinics | HCA Healthcare | 200+ | TX, VA, TN, FL | Urgent + walk-in care |

| 7 | Target Clinics | CVS Health | 80+ | Multi-state | Similar to MinuteClinic |

| 8 | MedExpress | Optum/United | 150+ | East Coast, Midwest | Urgent care, work-related care |

| 9 | Sutter Walk-In Care | Sutter Health | 10+ | California | Basic care, lab tests |

| 10 | Aurora QuickCare | Advocate Health | 20+ | WI, IL | Common illnesses, tests |

| 11 | FastMed Urgent Care | Independent | 100+ | AZ, TX, NC | Urgent + walk-in services |

| 12 | Bellin FastCare | Bellin Health | 5+ | Wisconsin | Basic services, quick consults |

| 13 | St. Luke’s QuickCare | St. Luke’s | 5+ | Idaho | Basic care |

| 14 | Riverview FastCare | Independent | Few | WI | Minor injuries and exams |

| 15 | Sanford Health Express | Sanford Health | 10+ | ND, SD, MN | Preventive and walk-in care |

| 16 | Concentra Walk-In Care | Concentra | 300+ total (varied) | Nationwide | Work injury, DOT physicals |

| 17 | Advocate Clinic at Walgreens | Advocate | 50+ | IL, WI | Co-branded retail care |

| 18 | CHI Health Quick Care | CHI Health | 15+ | NE, IA | Screenings and physicals |

| 19 | Banner Health Clinics | Banner Health | 20+ | AZ, CO | Quick medical attention |

| 20 | Geisinger ConvenientCare | Geisinger | 15+ | PA | Routine and urgent care |

Trends Shaping the Retail Clinic Industry in 2026

The growth of retail clinics continues to be fueled by several industry retail clinics trends:

1. Retail + Health Convergence

Retailers are doubling down on healthcare as a core service offering. CVS acquired Oak Street Health. Walgreens partnered with VillageMD. Walmart is expanding Walmart Health locations rapidly.

2. Increased Demand for Convenience

Patients seek fast, low-cost care with minimal disruption. Retail clinics deliver just that—proximity, extended hours, and digital scheduling.

3. Telehealth Integration

Many retail clinics now offer virtual consultations, expanding their reach while managing patient volume more efficiently.

4. Focus on Preventive and Chronic Care

Retail clinics are moving beyond acute conditions to manage chronic illnesses like diabetes and hypertension, and provide wellness support.

Why Retail Clinics Matter to Healthcare Marketers

If you’re a B2B retail healthcare provider, diagnostic company, medtech seller, or pharmaceutical marketer—retail clinics represent a high-impact market with:

- Rapid decision cycles

- High patient volumes

- Standardized care protocols

- Retail-oriented buying behavior

Why market to retail clinics?

- Product placement (e.g., diagnostic kits, devices)

- Brand partnerships

- Staff recruitment solutions

- Workflow automation and EMR software

- Lab and testing service sales

How to Reach Retail Clinic Decision-Makers Using Ampliz

Retail clinics operate differently from hospitals or physician groups. You need precise, clean, and verified decision-maker data to run effective outreach campaigns.

With Ampliz Healthcare Intelligence, you can:

- Access 1000+ verified retail clinic organizations

- Reach decision-makers like clinic managers, medical directors, NPs, and procurement heads

- Segment by location, job title, specialty, or EHR system used

- Integrate data directly into your CRM or marketing platform

Ideal for:

- Healthcare SaaS companies

- Medtech vendors

- Pharma sales teams

- Diagnostic service providers

- Recruiting agencies

Conclusion

Retail clinics in the USA are no longer just an alternative care setting—they are a critical access point for primary healthcare for millions of Americans. Their convenience, scale, and affordability make them a lucrative B2B market for healthcare marketers.

If you’re looking to penetrate this growing segment, Ampliz helps you cut through the noise with real-time, decision-maker-level intelligence on every retail clinic chain and location in the country.

Let Ampliz empower your outreach, enhance your conversion, and drive meaningful engagement in the evolving retail healthcare market.

📢 Ready to target top retail clinics in the USA?

Get started with Ampliz today.

🔗 www.ampliz.com

Tags

Get In Touch

All Categories

- Assisted Living Facilities

- B2B

- B2B Companies List

- B2B Marketing

- Canada Physicians Data

- Chiropractors

- Datacaptive Alternative

- Dental Marketing

- Digital Marketing

- Email Marketing

- Guest Post

- Healthcare Email Lists

- Healthcare Insights

- Healthcare Marketing

- Healthcare Marketing, Sales and Trends

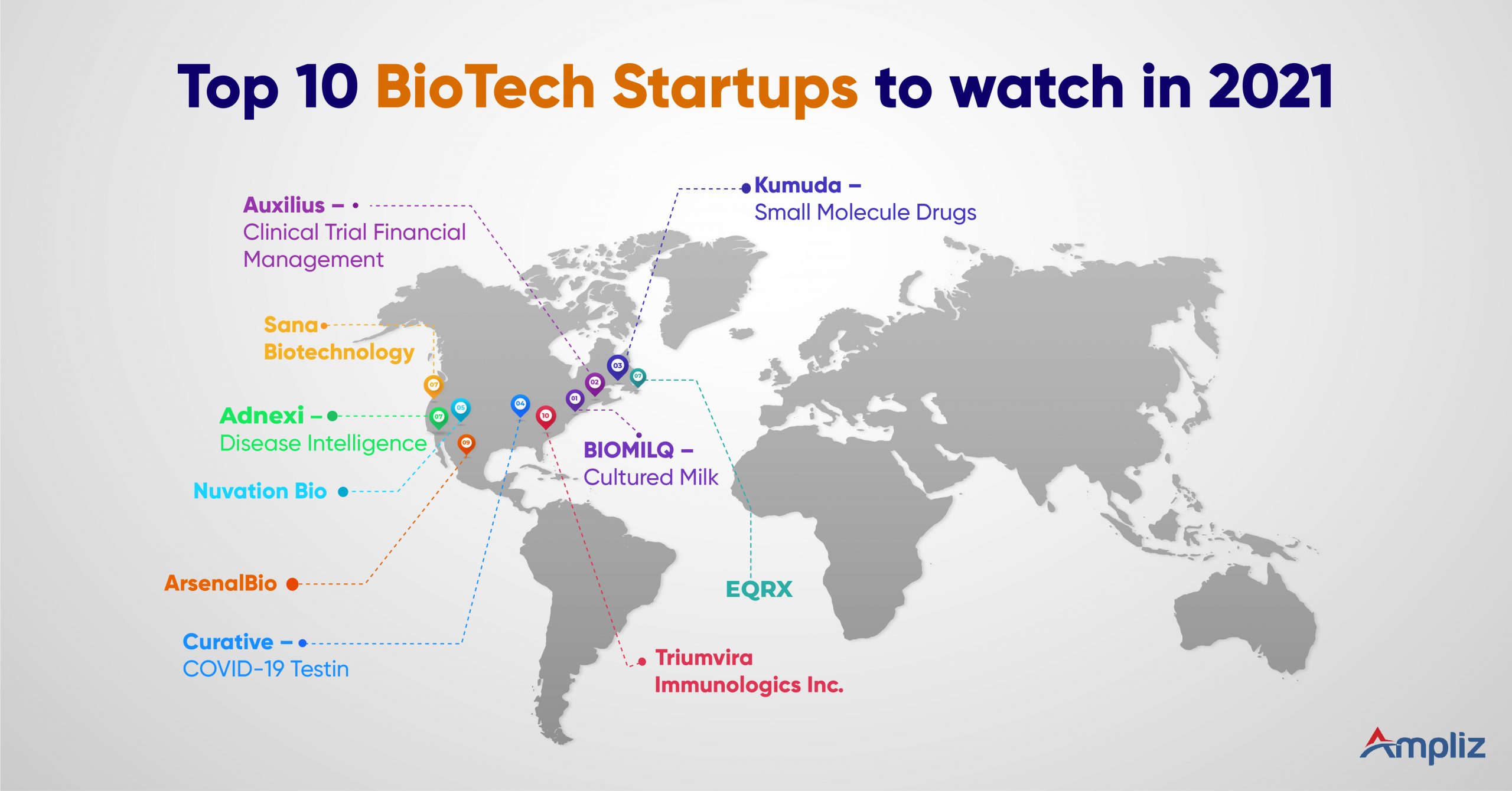

- Healthcare Startups

- Hospitals

- How To

- Locum Tenens Physicians and Nurses

- Long term Care

- lusha

- Marketing tools

- Medical Device

- Nursing Home

- Pharma

- Pharmaceutical companies

- Physician Groups By Speciality

- Physician Groups By State

- Physicians Database

- Psychiatrist Email List

- Recruitments Blogs

- Uncategorized

- US Healthcare Data

- US Hospitals

- US Physician Groups

- Zoominfo

Get Data Pricing

Request a quote for specialized healthcare and B2B datasets that actually convert.